Applying for a loan is a major financial decision, and at Hexafin, we understand that it should be easy, stress-free, and transparent. Whether you’re looking for funds to grow your business, manage personal expenses, or buy a new home, this guide will walk you through the process step by step.

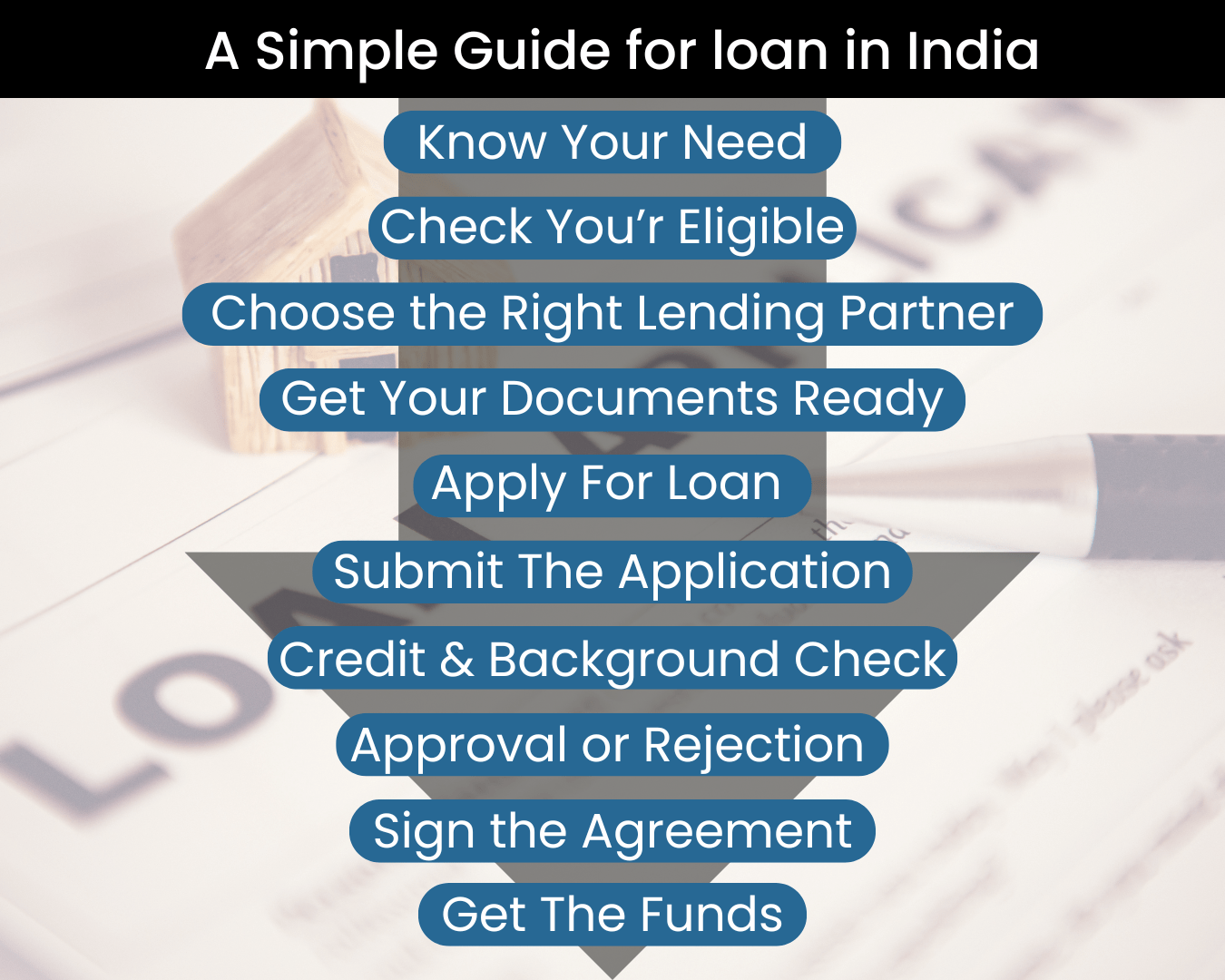

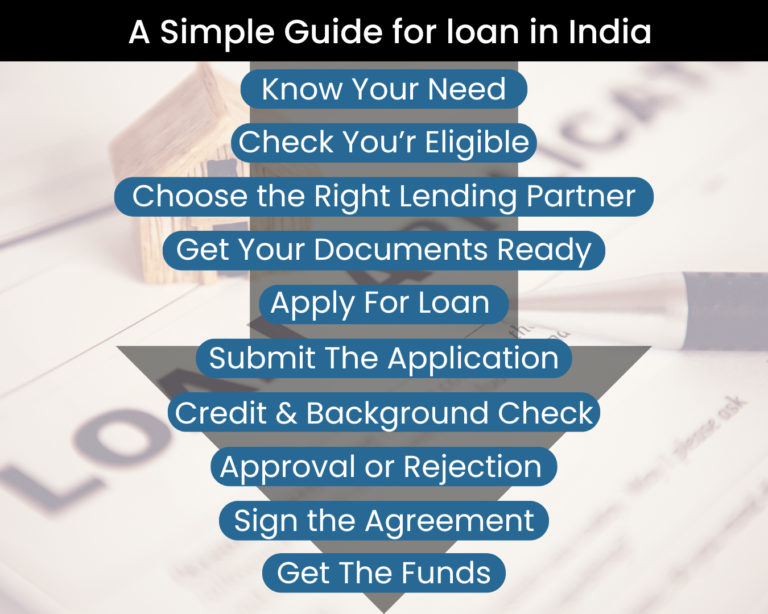

- Step 1: Know What You Need

Before starting the process, ask yourself:

- How much loan amount do I need?

- What is the purpose of this loan?

- How soon do I need the funds?

Clarity at this stage helps you choose the right loan type, and with Hexafin’s expert guidance, you’re never alone in making that choice.

- Step 2: Check If You’re Eligible

Loan eligibility depends on several factors:

- Your age and income

- Your profession (salaried or self-employed)

- Your credit score

- Your existing liabilities (if any)

At Hexafin, we help you understand where you stand and suggest the best loan options accordingly.

- Step 3: Choose the Right Lending Partner

Not all loans are the same and neither are the lenders. Comparing interest rates, processing fees, tenure, and customer service can make a big difference. That’s where Hexafin steps in.

We work with a wide network of banks and NBFCs to offer you the most suitable options—without the need to run around.

- Step 4: Get Your Documents Ready

Generally, you’ll need:

- PAN card and Aadhaar card

- Address proof

- Income proof (like salary slips or bank statements)

- Business proof (if applicable)

- Recent photographs

Hexafin’s team will guide you on exactly what’s needed for your loan type and help you with document collection and submission.

- Step 5: Apply for the Loan

Generally, you’ll need:

- PAN card and Aadhaar card

- Address proof

- Income proof (like salary slips or bank statements)

- Business proof (if applicable)

- Recent photographs

Hexafin’s team will guide you on exactly what’s needed for your loan type and help you with document collection and submission.

- Step 6: Submit the Application

Once your form and documents are ready, you submit them to the lender. With Hexafin, this part is even easier—we coordinate everything on your behalf so you can sit back and relax.

- Step 7: Credit & Background Check

The lender now checks your credit score and overall financial profile. If there are any red flags, you may be asked for clarification.

Hexafin pre-screens your profile and gives you feedback beforehand so there are no surprises.

- Step 8: Approval or Rejection

If everything checks out, your loan gets approved and you receive a sanction letter. If not, don’t worry—our team can help you work on the reasons and reapply with another lender if needed.

- Step 9: Sign the Agreement

Once approved, you’ll get a detailed loan agreement to sign. This includes your interest rate, EMI amount, repayment period, and other terms.

At Hexafin, we won’t let you sign blindly—we’ll walk you through every point so you’re fully aware of your commitments.

- Step 10: Get the Funds

Finally, the money is disbursed to your bank account. The time may vary depending on the loan type, but Hexafin ensures regular updates and smooth coordination till the money is in your hands.

- Final Thoughts

At Hexafin, we believe that applying for a loan shouldn’t be complicated. With the right partner and the right information, getting a loan can be simple and stress-free.

Whether you’re a salaried employee, a self-employed professional, or a business owner. We’ve got a loan solution for you.

📞 Ready to apply?

Talk to a Hexafin advisor today and get expert help with your loan journey.